The finance industry is a data-driven and highly regulated sector that deals with complex financial transactions and information. With the ever-increasing amount of data being generated and processed in this industry, it is no surprise that financial institutions are rapidly adopting Artificial Intelligence. AI in finance can process and analyze massive amounts of data quickly and accurately, providing insights to help financial institutions make more informed decisions.

In recent years, AI has transformed how financial institutions operate, from fraud detection and risk management to customer service and investment advice. As a result, the global AI in finance market is expected to increase at a compound annual growth rate of 41.7% from 2020 to 2027, reaching $26.58 billion by the end of the forecast period, according to a report by Allied Market Research.

This blog explores the various applications of AI in the finance industry, including fraud detection, risk management, trading and investment, customer service, and compliance. We will also discuss the benefits of AI in finance, such as increased efficiency, better decision-making, and improved customer experiences. Let’s look into the future of AI in finance, including the trends shaping the industry and the potential for further growth and development.

What is AI in Finance?

AI in finance involves using these technologies to automate processes, analyze data, and make decisions, to improve efficiency, lower costs, and provide better customer experiences. For example, machine learning algorithms can analyze large volumes of financial data to detect patterns and predict outcomes. In contrast, natural language processing can analyze customer interactions and sentiments, improving customer service.

In essence, AI in finance is about leveraging the power of technology to gain insights and make smarter decisions in a fast-paced and data-intensive industry. By automating repetitive and time-consuming tasks, financial institutions can concentrate on higher-value actions, such as developing new products and services and building stronger customer relationships.

While AI in finance is still in its early stages, it has the potential to transform the industry, making it efficient, transparent, and customer-focused. The benefits of AI in finance are numerous, from improving risk management and compliance to providing personalized investment advice and reducing fraud. As technology continues to evolve, you can expect to see even more exciting applications of AI in finance in the coming years.

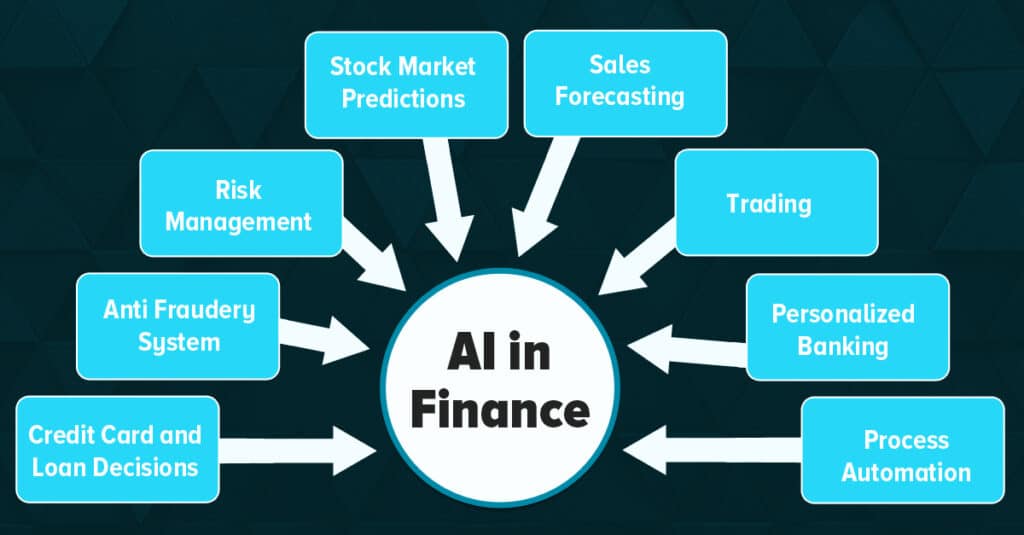

Use of AI in Finance

The use of Artificial Intelligence in finance has been increasing rapidly in recent years. Here are some of the major applications of AI in finance.

-

Fraud Detection and Prevention

One of the most standard applications of AI in finance is fraud detection and prevention. By analyzing large volumes of transaction data, AI algorithms can identify suspicious patterns and flag potentially fraudulent activities. This can help financial institutions prevent losses due to fraud and improve customer trust.

For example, PayPal uses machine learning algorithms to analyze user behavior and identify fraudulent transactions with a 95% accuracy rate. In another example, HSBC, a multinational banking and financial services company, uses AI to detect and prevent money laundering and terrorist financing, which has helped the company to reduce false positive alerts by 20%.

-

Risk Management

AI can also help financial institutions manage risks more effectively. By analyzing market data, credit scores, and other factors, AI algorithms can provide real-time risk assessments and recommend strategies for mitigating risks. This can help financial institutions with informed decisions and avoid losses due to unforeseen events.

For example, Goldman Sachs uses machine learning algorithms to analyze market data and identify potential risks in its investment portfolios. In another example, the Bank of Montreal uses AI to improve its credit risk management, which has led to a 5% increase in revenue and a 5% reduction in losses due to credit default.

-

Trading and Investment

By analyzing market data, AI algorithms can identify trends and predict future market movements, enabling financial institutions to make more informed investment decisions. AI can also automate trading and portfolio management, reducing costs and improving efficiency.

For example, BlackRock, the world’s largest asset manager, uses AI algorithms to manage over $7 trillion in assets and improve client investment outcomes. Another example is the use of AI by the hedge fund Two Sigma, which has delivered returns of over 25% annually since 2001.

-

Customer Service and Experience

AI is transforming customer service and experience in the finance industry. AI-powered chatbots and smart virtual assistants can deliver instant customer support, answer questions, and offer personalized financial advice. This can improve customer satisfaction and loyalty while reducing costs for financial institutions.

For example, Bank of America’s virtual assistant, Erica, has over 15 million users and has helped customers complete over 100 million transactions. Another example is the use of AI by the digital bank Ally Bank, which has reduced customer wait times from several minutes to less than 20 seconds.

-

Compliance and Regulatory Reporting

AI can also help financial institutions comply with regulatory requirements more efficiently. By automating compliance processes and analyzing data for regulatory reporting, AI algorithms can help reduce the risk of errors and streamline compliance efforts.

For example, JPMorgan Chase uses AI algorithms to analyze regulatory requirements and automate compliance processes, saving the bank over $150 million annually. Another example is the use of AI by the insurance company Allstate, which has reduced the time required for claims processing by 30% and improved compliance with regulatory requirements.

Benefits of AI in Finance

-

Improved Accuracy and Efficiency

AI can significantly improve the accuracy and efficiency of financial processes. Financial institutions can reduce errors and improve efficiency by automating repetitive tasks and analyzing data with machine learning algorithms. This can save time and money while also improving customer satisfaction. For example, Wells Fargo has implemented AI-powered tools that can process loan applications in minutes, reducing the time it takes to approve loans from days to hours.

-

Better Risk Management

AI can help financial institutions manage risks more effectively. By analyzing market data, credit scores, and other factors, AI algorithms can provide real-time risk assessments and recommend strategies for mitigating risks. This can help make more informed decisions and avoid losses due to unforeseen events. A report by Accenture found that AI-powered risk management systems could reduce credit losses by up to 30%.

-

Personalized Financial Advice

AI can provide personalized financial advice to customers based on their needs and preferences. For example, financial institutions can offer tailored financial advice and investment recommendations by analyzing customer data and using machine learning algorithms. This can improve customer satisfaction and loyalty while increasing the likelihood of positive investment outcomes.

-

Enhanced Cybersecurity

AI can also strengthen cybersecurity in the finance industry. By analyzing large volumes of data and detecting patterns in user behavior, AI algorithms can identify potential cyber threats and prevent attacks before they occur. This can help financial institutions protect sensitive customer data and prevent financial losses due to cybercrime.

For example, Capital One uses AI-powered tools to detect and prevent cyber attacks, reducing the risk of data breaches and other security incidents.

Moreover, AI offers numerous benefits to the finance industry, including improved accuracy and efficiency, better risk management, personalized financial advice, and enhanced cybersecurity. With continued advancements in AI technology, it is expected to see even more innovative applications of AI in finance.

Future of AI in Finance

The future of AI in Finance is undoubtedly exciting as the technology continues to advance and shape the industry. The potential benefits of AI in finance include efficiency, affordability, and improved customer experiences.

Some of the key trends that will shape the future of AI in finance are

- Continued Automation: Financial institutions will continue to automate processes using AI and other technologies. AI-powered automation will allow for more accurate and efficient decision-making, improving overall efficiency while reducing costs. For example, chatbots and virtual assistants will become more sophisticated, allowing financial institutions to handle customer interactions without human intervention.

- Greater Personalization: AI will enable financial institutions to provide customers with more personalized services and products based on their needs and preferences. By examining customer data and behavior, AI algorithms can recommend personalized investment strategies, offer tailored financial advice, and provide more customized services. This can lead to higher customer satisfaction and loyalty and increased revenue for financial institutions.

- Increased Collaboration: Financial institutions will collaborate with tech companies and startups to develop new AI applications and technologies, accelerating innovation in the industry. This collaboration will enable financial institutions to keep up with new AI advancements and provide better services and experiences to customers.

- Ethical Considerations: As the use of AI becomes more widespread in finance, there will be increased scrutiny and regulation around the ethical use of these technologies, particularly concerning issues such as bias and transparency. Financial institutions must ensure that AI algorithms are transparent, fair, and unbiased while protecting customer data and privacy.

- New Applications: AI is a rapidly evolving field, and new applications and technologies will continue to emerge in the finance industry. For example, AI-powered personal financial assistants may become more prevalent, providing financial advice and recommendations based on individual financial goals and preferences. Additionally, AI could be used to create more accurate and efficient credit scoring systems, reducing the number of individuals who are unfairly denied access to credit.

Hence, AI has the potential to transform the finance industry in significant ways, improving efficiency, reducing costs, and providing more personalized experiences for customers. However, as technology evolves, financial institutions must remain vigilant about ethical considerations and collaborate with tech companies and startups to develop new AI applications and technologies that benefit customers and the industry.

Top stats about AI in Finance:

- The global AI in finance market is projected to reach $26.58 billion by 2027, growing at a compound annual growth rate of 41.7% from 2020 to 2027. (Allied Market Research)

- Financial services firms implementing AI could see an average cost savings of 22% by 2030. (Accenture)

- The adoption of AI in finance is expected to increase the global GDP by 1.2% by 2030. (PwC)

- By 2024, the total spending on AI in the financial industry is expected to exceed $11 billion. (IDC)

- In 2020, the top three AI use cases in finance were fraud detection and investigation, risk management, and process automation. (Deloitte)

- AI-powered chatbots and virtual assistants could save banks up to $8 billion annually by 2022. (Juniper Research)

- AI-driven personalization can increase revenue for financial institutions by up to 15%. (Deloitte)

- 77% of consumers are comfortable using AI to improve fraud detection, and 74% are comfortable with it for managing their finances. (Accenture)

- 83% of financial services companies believe AI will be extremely important in their business within the next two years. (The Economist Intelligence Unit)

- Implementing AI in lending has led to a 40% increase in productivity, a 20% reduction in customer acquisition costs, and a 70% reduction in processing time. (Forrester Research)

Also Check : Your Guide to AI powered Database

Conclusion

AI has become an integral part of the finance industry, providing numerous benefits to financial institutions and their customers. From fraud detection to trading and customer service, AI transforms how financial services are delivered and experienced. As the industry continues to evolve, it’s clear that AI and other advanced technologies will increasingly drive the future of finance.

To stay ahead in this rapidly evolving landscape, financial institutions must partner with leading AI technology providers such as advansappz. advansappz has a proven track record of delivering innovative and effective AI solutions to finance companies, helping them unlock new opportunities and achieve their business objectives. By leveraging the power of AI, financial institutions can drive growth, improve efficiency, and enhance the customer experience, ultimately achieving success in today’s dynamic and competitive marketplace.

Frequently Asked Questions

AI is utilized in banking and finance in several ways: Risk Assessment: AI can analyze vast amounts of data to assess credit risks accurately, helping banks make informed lending decisions. Fraud Detection: AI algorithms can detect suspicious transactions and patterns, reducing fraudulent activities and enhancing security. Customer Service: Chatbots powered by AI can assist customers with routine inquiries, providing 24/7 support and improving user experience. Personalized Recommendations: AI can analyze customer behavior and offer tailored financial product suggestions, enhancing cross-selling opportunities. Algorithmic Trading: AI-driven algorithms can make faster and more precise trading decisions, optimizing investment strategies. Anti-Money Laundering (AML) Compliance: AI helps banks comply with AML regulations by identifying potential money laundering activities. Predictive Analytics: AI models can forecast market trends, enabling financial institutions to make strategic decisions. Robo-Advisors: AI-powered robo-advisors provide automated and cost-effective investment advice based on individual preferences. Process Automation: AI streamlines various back-office tasks, reducing manual errors and operational costs. Data Security: AI can bolster cybersecurity by identifying potential vulnerabilities and thwarting cyber threats.

To implement AI in finance:

-

Data collection: Gather relevant financial data from various sources, such as stock prices, economic indicators, and news articles.

-

Data preprocessing: Clean, normalize, and transform the data to ensure it’s suitable for AI algorithms.

-

Select AI techniques: Choose appropriate AI methods, such as machine learning, deep learning, or natural language processing, based on your specific finance-related tasks.

-

Model training: Train AI models using historical data to learn patterns and relationships.

-

Real-time analysis: Implement the trained models to analyze incoming data and generate predictions or insights.

AI and automation will significantly shape finance in the future. They will revolutionize tasks like fraud detection, risk assessment, customer service, and portfolio management. By streamlining processes and providing data-driven insights, AI will enhance decision-making and improve efficiency. Automation will also simplify routine tasks, reducing manual errors and freeing up human resources for more strategic roles. Overall, AI and automation will lead to a more efficient, accurate, and personalized financial experience for both businesses and consumers.

AI can be used in finance in various ways, including:

-

Risk Assessment: AI algorithms can analyze large volumes of financial data to assess and manage risks effectively.

-

Algorithmic Trading: AI-powered trading systems can identify patterns and execute trades autonomously, optimizing investment strategies.

-

Fraud Detection: AI can detect unusual activities and patterns in transactions, helping to prevent and combat financial fraud.

-

Customer Service: AI-driven chatbots and virtual assistants can provide personalized support and streamline customer interactions.

-

Credit Scoring: AI models can evaluate creditworthiness more accurately, leading to better lending decisions.

-

Portfolio Management: AI can recommend and manage portfolios tailored to individual investors’ needs and risk profiles.

-

Market Analysis: AI can process vast amounts of market data to provide insights and predict market trends.

-

Natural Language Processing: AI can analyze unstructured data from news articles and social media to gauge market sentiment.

-

Automated Compliance: AI can assist with regulatory compliance by monitoring transactions and ensuring adherence to laws.

-

Quantitative Research: AI techniques can be used to develop and refine quantitative models for financial analysis.

AI in finance refers to the application of artificial intelligence (AI) technologies in the financial industry. It involves using advanced algorithms and machine learning techniques to analyze vast amounts of financial data, identify patterns, make predictions, and automate decision-making processes. AI in finance can be used for tasks such as risk assessment, fraud detection, algorithmic trading, customer service, and personalized financial recommendations. Its integration in the financial sector aims to improve efficiency, accuracy, and provide better insights for informed decision-making.

AI can be used in finance in various ways, such as:

-

Risk assessment: AI can analyze vast amounts of data to identify potential risks and predict market fluctuations.

-

Fraud detection: AI can spot unusual patterns in transactions, helping to prevent and detect fraudulent activities.

-

Algorithmic trading: AI algorithms can execute trades based on predefined strategies, optimizing investment decisions.

-

Customer service: AI-powered chatbots can handle customer inquiries, providing efficient and personalized support.

-

Credit scoring: AI can assess creditworthiness more accurately by considering multiple data points, leading to better lending decisions.