Technological advancements have shaped how professionals manage and process financial data in the fast-paced finance and accounting world. One such innovation in recent years is blockchain technology. Originally developed as the underlying technology for cryptocurrencies like Bitcoin, blockchain has since emerged as a transformative force with the potential to revolutionize various industries, including accounting.

Blockchain technology has had its ups and downs over the past decade, but it is now revitalizing the financial sector, intellectual property, and sustainability through distributed ledger technology (DLT). In this article, we will delve into the impact of blockchain technology on accounting practices, highlighting its advantages, obstacles, and potential for the industry’s future.

What Is Blockchain?

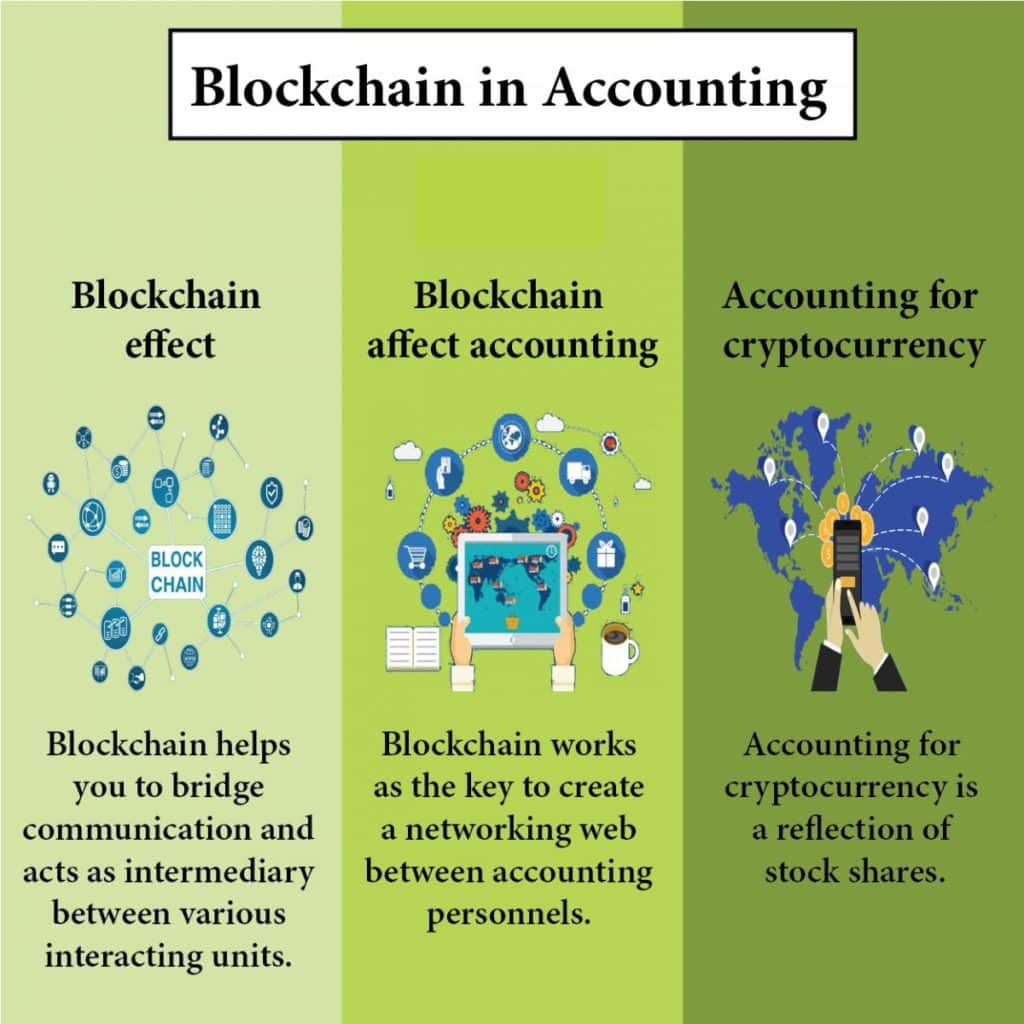

Blockchain is a technology that connects people or companies directly or on a peer-to-peer basis. For the past 20 years, people have shared information through the internet. They have sent emails, posted to social media, and transmitted documents. Blockchain, as a technology, takes the connectivity of the internet one step further. Blockchain offers users the internet of value.

As opposed to exchanging only information, participants can now exchange value on a peer-to-peer basis. Although most commonly associated with Bitcoin and other crypto assets, blockchain technology supports applications (such as decentralized apps or dAPPs) and complex programming (such as smart contracts). Through these smart contracts, blockchain offers the potential to undertake a wide range of transactions and transference of rights and property quickly and efficiently.

Smart contracts can quickly and cost-effectively transfer ownership of a car or transfer corporate shares without needing a third party, such as a bank or a stockbroker, and with immediate settlement. This removal of “middlemen” by enabling trusted peer-to-peer exchange is driving what some have come to refer to as “Web 3.0” and the creation of $2 trillion of wealth in the last ten years.

The Benefits of Blockchain in Accounting

Increased Security

Security is a major concern in accounting. Blockchain addresses this with its decentralized nature. Each transaction is encrypted and linked to the previous one. This makes it nearly impossible to alter any records. Thus, blockchain provides a highly secure environment for financial data.

Improved Efficiency

Efficiency in accounting is crucial. Blockchain automates many accounting processes. It reduces the need for manual entry and reconciliation. Smart contracts facilitate automatic execution of terms. This speeds up transactions and reduces costs.

Real-Time Auditing

Auditing is time-consuming and costly. Blockchain enables continuous auditing. Auditors can access real-time data, streamlining the process. This ensures accuracy and reduces the chances of discrepancies. Real-time auditing also enhances regulatory compliance.

Better Compliance

Regulatory compliance is mandatory in accounting. Blockchain simplifies compliance with its transparent and secure nature. It provides an immutable record of all transactions. This makes it easier to meet regulatory requirements. Additionally, it reduces the risk of non-compliance penalties.

The Role of Blockchain Accounting Software

Blockchain accounting software is a type of financial software that utilizes blockchain technology to enhance and streamline accounting processes. It leverages the critical features of blockchain, such as immutability, transparency, and decentralization, to provide a more secure and efficient platform for recording, managing, and verifying financial transactions. This software is designed to simplify tasks like ledger maintenance, auditing, and financial reporting while reducing the risk of errors and fraud. It often incorporates smart contracts to automate financial agreements and transactions.

Blockchain accounting software is becoming increasingly popular as businesses seek to improve their accounting practices and adapt to the digital transformation of economic systems.

The Impact of Blockchain Technology on Accounting

Enhanced Transparency and Trust

Blockchain technology provides an immutable and decentralized ledger system, allowing for transparent and secure transactions. In accounting, every financial transaction can be recorded on the blockchain, creating a transparent and auditable data trail.

With all stakeholders having access to the same information in real-time, the real-time parties can be significantly improved, reducing the need for intermediaries and increasing the accuracy of financial reporting.

Streamlined Auditing and Compliance

Auditing is a critical aspect of accounting, ensuring the accuracy and integrity of financial records. Traditional auditing processes can be time-consuming and resource-intensive. However, with blockchain, auditing becomes more efficient and cost-effective. The distributed nature of blockchain allows auditors to access a tamper-proof record of transactions, eliminating manual verification. This streamlined auditing process can enhance compliance with regulatory requirements and improve the overall efficiency of the accounting profession.

Smart Contracts Automating Accounting Functions

Blockchain technology enables smart contracts, self-executing contracts with predefined rules encoded on the blockchain. Smart contracts can automate accounting functions like invoice processing, payment settlements, and financial reconciliations.

By eliminating manual intervention, smart contracts reduce human error and enhance operational efficiency. Accountants can focus on higher-value tasks, such as financial analysis and strategic decision-making, while routine accounting processes are automated through smart contracts.

Secure Data Storage and Protection

Data security is a paramount concern for accounting professionals. Blockchain’s decentralized and cryptographic nature provides enhanced data security. As each transaction is encrypted and linked to previous transactions in a chain, altering or tampering with the data becomes extremely difficult. This immutability of the blockchain helps prevent fraud and unauthorized modifications, ensuring the integrity and confidentiality of financial information.

Cost Reduction and Increased Efficiency

Traditional accounting processes often involve multiple intermediaries and manual data entry, increasing costs and potential errors. Blockchain technology can streamline these processes by automating record-keeping, reducing the need for intermediaries, and enhancing the efficiency of transactions. This cost reduction and increased efficiency can benefit businesses of all sizes, from small startups to large enterprises, allowing them to allocate resources to more value-added activities.

Implications of Blockchain for Auditors

Blockchain in auditing has its applications. Performing confirmations of a company’s financial status would be less necessary if some or all transactions underlying that status were visible on blockchains. This proposal would mean a profound change in the way that audits work. When combined with appropriate data analytics, a Blockchain solution could help with the transactional level assertions involved in an audit, and the auditor’s skills would be better spent considering higher-level questions.

For example, auditing is not just checking the details of whom a transaction was between and the monetary amount, but also how it is recorded and classified. If a transaction credits cash, is this outflow due to the cost of sales or expenses, or is it paying a creditor or creating an asset? These judgemental elements often require context that is not available to the general public but requires business knowledge. With blockchain, the auditor will have more time to focus on these questions.

Skills Every Accountant Will Need for the Future

To increase the efficiency and value of the accounting function, professionals need to understand data analytics, machine learning, blockchain, and other modern technologies. Blockchain and smart contract approaches can transform subfields of accounting, such as transactional assurance and transfer of property rights.

As a result, the spectrum of skills represented in accounting is bound to change. To mention a few, they are:

- Reduction or elimination of works like reconciliations and provenance reassurance

- Expansion of work related to technology, advisory, and value-adding activities

- Focus on transaction recordings and their recognition in financial statements

- Decision on elements of judgment such as valuation

- Confirmation of transactions in real-time and with certainty

Challenges and Considerations

Scalability

Blockchain networks need to work on handling high transaction volumes and achieving fast processing speeds. Scalability issues can hinder widespread adoption, particularly in applications requiring high throughput, like global payment systems.

Integration with Existing Systems

Integrating blockchain with established accounting systems and regulatory frameworks can be complex. Compatibility and compliance with existing standards and practices must be carefully considered to ensure a smooth transition.

Legal and Regulatory Frameworks

The evolving nature of blockchain technology poses legal and regulatory challenges. Governments and regulatory bodies are working to adapt to this technology, but uncertainties remain. Compliance with laws and regulations can be a hurdle for businesses adopting blockchain.

Interoperability

Different blockchain platforms may need to be compatible, creating interoperability challenges. Seamless data sharing and transactions across various blockchain networks are essential for maximizing the technology’s potential.

Data Privacy and Security

While blockchain offers robust security, ensuring data privacy and protecting against potential vulnerabilities, such as 51% attacks, is crucial. Balancing transparency with data protection is an ongoing challenge.

Energy Consumption

Proof-of-work (PoW) blockchain networks can be energy-intensive. Given the increasing focus on sustainability, finding environmentally friendly consensus mechanisms is a concern.

Also Read: Top 5 Blockchain Platforms to Watch in 2023

Final Words

Blockchain technology is on the brink of reshaping the entire accounting landscape, bringing forth benefits that include enhanced transparency, streamlined auditing, smart contract automation, secure data storage, and cost reduction. Amidst the challenges of such innovation, the potential for amplified efficiency, reduced fraud, and heightened stakeholder trust is too significant to ignore.

As technology continues its relentless evolution, accountants and financial professionals are at a crucial crossroads. The transformative power of blockchain demands adaptation for those seeking to stay ahead in the dynamic realm of finance and accounting. Enter advansappz, a key player addressing blockchain’s promises and challenges in accountancy. Their offerings, from streamlined integration and regulatory compliance to a clear pathway for revolutionizing accounting processes, make them indispensable in reshaping the financial landscape.

Frequently Asked Questions

Blockchain technology is a decentralized and distributed ledger system that records and verifies transactions across a network of computers. It uses cryptographic techniques to secure data and ensures transparency and immutability.

Unlike traditional databases, which are typically centralized, blockchain operates decentralized. It doesn’t rely on a central authority, making it more secure and resistant to fraud or manipulation.

Smart contracts are self-executing contracts with the terms of the agreement written into code. They automatically execute and enforce the terms when predefined conditions are met, eliminating the need for transaction intermediaries.

Blockchain is considered highly secure due to its cryptographic algorithms and decentralized nature. Once a transaction is recorded on the blockchain, it’s complicated to alter, providing high security and trust.

Blockchain has many applications, including cryptocurrency (e.g., Bitcoin), supply chain management, identity verification, voting systems, and financial services. It is also explored in healthcare, real estate, and legal contracts.