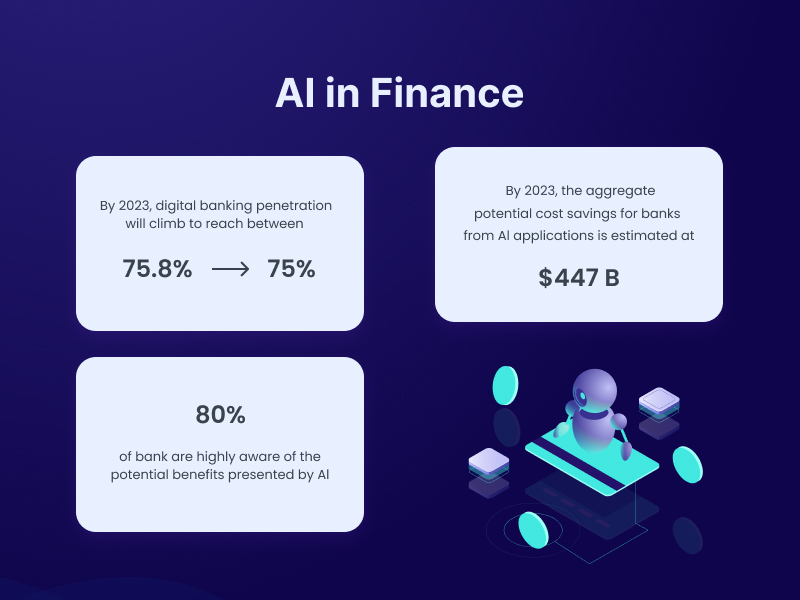

Artificial Intelligence (AI) has transformed the finance industry, providing financial institutions unparalleled capabilities to automate tasks, improve decision-making, and reduce risks. According to a report by Allied Market Research, the global AI in the financial market was valued at $1.01 billion in 2019 and is expected to reach $22.6 billion by 2027, growing at a CAGR of 37.2% from 2020 to 2027. The increasing adoption of AI technologies in financial risk management, fraud detection, and customer service drives this growth

The finance industry has greatly benefited from AI technology’s capacity to analyze large amounts of data quickly. This has allowed financial institutions to make informed decisions, reduce risks, and improve customer experiences. In this blog, we will learn how AI has revolutionized the finance sector, focusing on AI in financial risk management.

AI in financial Risk management is crucial for several reasons:

Protecting Investments

The finance industry deals with a wide range of investments. Therefore, it is essential to protect these investments from various risks, such as market volatility, liquidity risk, credit risk, and operational risk. Risk management helps to identify and assess these risks and implement strategies to mitigate them.

Example: Imagine a portfolio manager who invests in the stock market and needs to assess the risks associated with the investments adequately. If the market goes through a significant downturn, the portfolio could experience substantial losses. However, if the portfolio manager had employed risk management strategies such as diversification, hedging, or position sizing, they could have mitigated the risks and protected the investments.

Regulatory Compliance

Compliance with various regulations is crucial in the finance industry to avoid legal and financial penalties as it is highly regulated. Risk management is critical to ensuring compliance with Basel III, Dodd-Frank Act, and Solvency II laws.

Example: Banks, insurance agencies, and other financial institutions are subject to numerous regulations, such as Basel III, which sets capital requirements for banks. If a bank fails to comply with these regulations, it could face significant legal and financial penalties. However, if the bank had implemented risk management strategies, such as stress testing, scenario analysis, or contingency planning, it could have avoided non-compliance issues and maintained a healthy balance sheet.

Reputation Management

The finance industry relies heavily on its clients’ and stakeholders’ trust and confidence. Any failure to manage risks can result in significant financial losses and damage the company’s reputation. Risk management helps to identify and mitigate potential risks before they can cause substantial harm to the business.

Example: In 2008, several large banks suffered significant losses due to the subprime mortgage crisis. These losses damaged the reputation of the banks, resulting in decreased confidence and trust from their clients and stakeholders. However, banks implementing risk management strategies, such as rigorous credit analysis and stress testing, were better prepared to weather the crisis and protect their reputation.

Enhancing Performance

Effective risk management can help financial institutions to improve their performance and competitiveness by identifying and exploiting opportunities that arise from market volatility and changes in the economic environment.

Example: Hedge funds are a prime example of how risk management can enhance performance. Hedge funds employ risk management strategies, such as short selling, derivatives, and leverage, to manage risks and exploit market opportunities. By doing so, they can generate high returns for their investors while limiting their downside risks.

What specific AI technologies are being adopted in financial risk management?

Adopting AI in financial risk management is transforming how financial institutions assess, monitor, and mitigate risks. These technologies improve risk assessment accuracy, identify potential risks, and enhance decision-making. Here are some of the specific AI technologies being adopted in financial risk management:

- Machine Learning (ML): Financial institutions use ML algorithms to analyze large volumes of data and catch patterns and trends. This aids in making informed decisions regarding investments, lending, and risk management. The algorithms can assess creditworthiness by analyzing a borrower’s credit history, income, and other factors, which helps to evaluate credit risk. Additionally, ML can identify potential market risks and trends based on market data, assisting in analyzing market risk.

- Natural Language Processing (NLP): NLP algorithms can analyze various forms of unstructured data, including news articles, social media posts, and customer feedback, to identify potential risks and trends. By analyzing customer feedback, for instance, NLP can help identify potential issues with products or services that could harm a company’s reputation.

- Robotic Process Automation (RPA): RPA is used to automate repetitive tasks such as data entry, account reconciliation, and report generation, freeing time for financial professionals to focus on more strategic tasks. RPA can also be used to automate compliance tasks such as regulatory reporting and KYC checks.

- Deep Learning: Complex data, such as images and videos, can be analyzed by deep learning algorithms to detect possible risks and trends. For instance, companies operating in specific areas can use satellite images assessed by deep learning to identify potential environmental hazards.

- Neural Networks: Neural networks are used to analyze large datasets to identify patterns and trends. This helps financial institutions identify potential risks and make informed decisions. Neural networks can be used to diagnose operational risk by identifying potential areas of weakness based on data from internal systems.

These AI technologies are transforming financial risk management by providing financial institutions with more accurate risk assessments, reducing the risk of default, and improving customer experiences.

Use Cases of How is AI Used in Finance?

The finance sector utilizes AI-based risk management in multiple ways, such as enhancing customer experiences, handling routine tasks, and managing financial risks. Check out the following examples of how AI is being employed in finance.

- Fraud Detection: AI in financial risk management uses machine learning algorithms to analyze large datasets of financial transactions to identify patterns and anomalies that could indicate fraud. These systems can also learn from past incidents to improve accuracy over time.

- Chatbots: Financial institutions use AI-powered chatbots to improve customer experiences and offer 24/7 support. These chatbots can provide basic information, account details, and transaction assistance.

- Personalized Investment Advice: Investment platforms that utilize AI can offer customized investment advice based on a customer’s risk tolerance, investment objectives, and other factors. These platforms employ machine learning algorithms to analyze market data and pinpoint investment prospects.

- Credit Scoring: AI credit scoring systems can analyze a borrower’s credit history, income, and other factors to assess creditworthiness. These systems can provide more accurate assessments than traditional credit scoring methods.

- AI in Credit Risk Management: AI can analyze credit risk by using ML algorithms to assess creditworthiness. By analyzing a borrower’s credit history, income, and other factors, AI can provide lenders with a more accurate credit risk assessment. This can help financial institutions make better lending decisions and reduce the risk of default.

- Loan Underwriting: Loan underwriting with AI systems can automate assessing loan applications, reducing the time and cost of manual underwriting. These systems can analyze data from various sources to evaluate creditworthiness and determine loan terms.

- AI in financial risk management: AI is used to analyze data to identify potential risks and improve decision-making in financial risk management. This includes analyzing market data to identify trends and assess market risk, analyzing credit data to determine credit risk, and analyzing operational data to identify potential threats.

- Trading: Trading systems that utilize artificial intelligence technology rely on machine learning algorithms to study market trends and recognize potential trading options. These systems can execute trades automatically according to preset guidelines and learn from previous trading data to enhance their precision.

- Cybersecurity: AI can help financial institutions to strengthen their cybersecurity measures by identifying potential threats and vulnerabilities. AI-based algorithms can analyze network traffic and user behavior, detecting anomalies that could indicate a possible cyber attack. According to a report by Capgemini, AI-based cybersecurity could result in up to a 20% reduction in cybersecurity incidents.

Managing risks using AI and machine learning: Overcoming challenges and finding solutions

Challenges of leveraging AI in Financial risk management-

Data Quality and Availability: One of the key challenges in using AI and machine learning for risk management is ensuring that the data used is of high quality and readily available. Although financial institutions collect vast amounts of data, not all are useful or relevant for risk management. Therefore, ensuring that the data is accurate, comprehensive, and clean is essential for the success of AI-based risk management solutions.

Bias and Discrimination: Another hurdle is the potential for prejudice and discrimination in AI in financial risk management solutions. The accuracy of AI algorithms depends on the quality of data used to train them. The resulting solutions will also be if the data is biased or discriminatory. Therefore, it is crucial to develop transparent and unbiased AI-based solutions.

Model Interpretability: AI in financial risk management models can be intricate and challenging to interpret, making it difficult for financial institutions to comprehend how the models arrive at their conclusions. This can result in a lack of trust in the models and reluctance to rely on them for critical decision-making.

Solutions for effortlessly managing AI in financial risk management-

Data Governance: By implementing effective data governance policies and procedures, financial institutions can ensure that the data they use for AI-based risk management solutions are clean, accurate, and relevant. This can be achieved through data validation, cleansing, and normalization.

Fairness and Transparency: To address the issue of bias and discrimination in AI in financial risk management solutions, financial institutions should ensure that the data used to train the models is diverse and representative of the population. Furthermore, solutions should be transparent and explainable, so financial institutions can comprehend how the models reach their conclusions.

Model Explainability: To improve the interpretability of AI and machine learning models, financial institutions can use techniques such as model visualization, feature importance analysis, and model explanations. These techniques can provide insights into how the models arrive at their conclusions, enhancing trust and understanding.

Moreover, AI and machine learning can potentially revolutionize risk management in the financial industry. However, some challenges must be addressed. Financial institutions can overcome these challenges by focusing on data quality and governance, fairness and transparency, model interpretability, and realizing the benefits of AI-based risk management solutions.

Tips Before Choosing AI Consulting for Your Business

If you are considering hiring an AI consulting service for your business, here are some tips to help you choose the right service provider:

- Define Your Objectives: Defining your project’s objectives is key to finding the right AI consulting services. It helps you communicate your needs and make an informed decision to help you achieve your objectives.

- Assess Your Needs: Assess your business needs and determine which AI services, like machine learning or natural language processing, can benefit your organization. Then, find specialized AI and financial risk management services that align with your needs.

- Research Potential Service Providers: Do research when choosing from your shortlisted AI solution companies. Check their website, online reviews, and ask for recommendations. Evaluate their offerings, expertise, experience, and success rate in previous AI in financial risk management projects.

- Ask for Case Studies: To choose AI for financial risk management, ask for case studies and references to assess their capabilities and past client experiences.

- Evaluate Communication and Collaboration: Effective communication and collaboration are crucial to successfully employing AI in financial risk management. Assess the service provider’s responsiveness and willingness to work closely with your team to ensure the project meets your needs.

- Discuss Data Security and Privacy: When hiring for Consulting AI requirements for financial risk management projects, ask about their data security measures, certifications, and history of security breaches to ensure your sensitive data is protected.

- Understand the Cost: Consider the expertise and complexity of your AI project when seeking consulting services. Understand the pricing model and ensure it aligns with your budget and expected return on investment.

By following these tips, you can choose an AI consulting service provider that can help you achieve your business goals and maximize the benefits of AI in financial risk management for your organization.

Also Check: AI in Finance: A Comprehensive Guide

Deploy AI in your Financial Risk management project Today!

In conclusion, as the finance industry continues to grow and evolve, integrating AI into financial risk management has become increasingly crucial. Choosing the right AI consulting services or AI solution companies can help businesses effectively identify, assess, and manage risks. However, it is essential to determine your needs, research potential service providers, evaluate communication and collaboration, and discuss data security and privacy concerns to mitigate risk using AI in financial risk management successfully.

By following these tips, businesses can select a reliable and competent AI consulting service that can help them harness the full potential of AI for their financial risk management needs.